From $500k Debt to Freedom in 2 Years: The Amazon Couple Who Quit the Franchise Grind

At Growshine, we believe that real financial guidance is rooted in trust, personal connection, and community care—not complex franchise formulas. By staying independent, we’ve been able to focus on delivering customized financial and insurance plans that reflect what matters most to you, our clients.

Personalized, Local Service

- Every client works with a dedicated advisor who takes time to understand future goals, unique family needs, and evolving circumstances.

- Our team draws up sustainable, tailored payment models—ensuring you get the right plan, not just the most popular one.

Transparent Advice, Real Relationships

- We demystify the insurance process, clarifying terms, rider features, and long-term benefits so you can make informed decisions confidently.

- You get updates from real people who know your file, not from a generic franchise call center.

Flexible Solutions and Genuine Support

- As your needs change, your Growshine agent helps you explore plan upgrades, adjustments, or switches that work for you—without franchise restrictions slowing things down.

- We’re proud that our personalized approach has earned us client trust, successful referrals, and community loyalty across the USA.

Why This Matters

By choosing to grow organically—not by franchising—Growshine can innovate faster, respond directly to your feedback, and stay true to our mission: empowering you with financial security and clarity for every stage of life.

Chapter 1: The Story of Siri & Krishna—The Amazon Dream That Turned Into Pressure

Siri and Krishna moved to Seattle with the same excitement many young couples feel—good salaries at Amazon, a cozy new home, and the arrival of their beautiful baby girl. But life behind the social media photos was tightening around them quickly. The Real Problem A huge mortgage Rising childcare costs Living in one of America’s most expensive cities And worst of all:

The franchise they started to earn “extra income” became their biggest burden What they thought would be “easy side income” turned into a second full-time job. The Trap They were hit by harsh realities: No manpower High labor charges in Seattle Expensive monthly rents Unpredictable employees Endless operational stress And two full-time Amazon jobs plus a newborn Their “side hustle” was costing them: Peace Sleep Mental space Financial stability Time with their newborn daughter—they felt stuck, exhausted, and financially drained.

Chapter 2: The Unexpected Turning Point

During a weekend community event, Siri & Krishna came across a discussion about GrowShine’s unique approach—one without franchising, branches, heavy investments, royalty fees, staffing issues, or sales pressure. It was a simple conversation, yet it quietly opened a new direction in their lives.

Chapter 3: The Two-Year Freedom Plan

Siri & Krishna decided to quit the franchise system and start fresh. With GrowShinefin’s guidance and a step-by-step plan, they achieved the unthinkable: In just 24 months, they: Completely cleared their massive home loan Shut down their failing franchise Rebuilt their financial plan Reduced monthly stress Gained time for their daughter Regained confidence in their future For the first time in years, they felt peace instead of pressure. Their story is not rare. It is exactly why GrowShinefin does not operate like a franchise.

Chapter 4: Why GrowShinefin Rejects the Franchise Model

Franchising works well for restaurants, retail shops, gyms, and fast-moving consumer brands—but financial education and estate planning require trust, clarity, and personal attention, not scripts or sales pressure. Families making decisions about wills, trusts, retirement, and tax strategies need guidance that adapts to their culture and life stage.

Franchise systems add layers that weaken authenticity:

- Royalty fees & franchise owners

- Standardized scripts

- Rigid rules & quotas

- Limited flexibility in advice

When discussing family assets, inheritance, elder care plans, and retirement money, these layers become barriers.

GrowShinefin removes all of them—so the focus stays entirely on the family.

Chapter 5: The GrowShinefin Community-First Model

Instead of building branches, GrowShinefin builds trust through community relationships, cultural understanding, and simple education. Our approach is designed around real human connection, not corporate expansion.

1. Our community-first model grows through:

- Educational webinars

- Local community engagement

- WhatsApp guidance groups

- Indian cultural understanding

- Personalized, one-on-one consultations

Franchises aim for consistency. GrowShinefin builds connection.

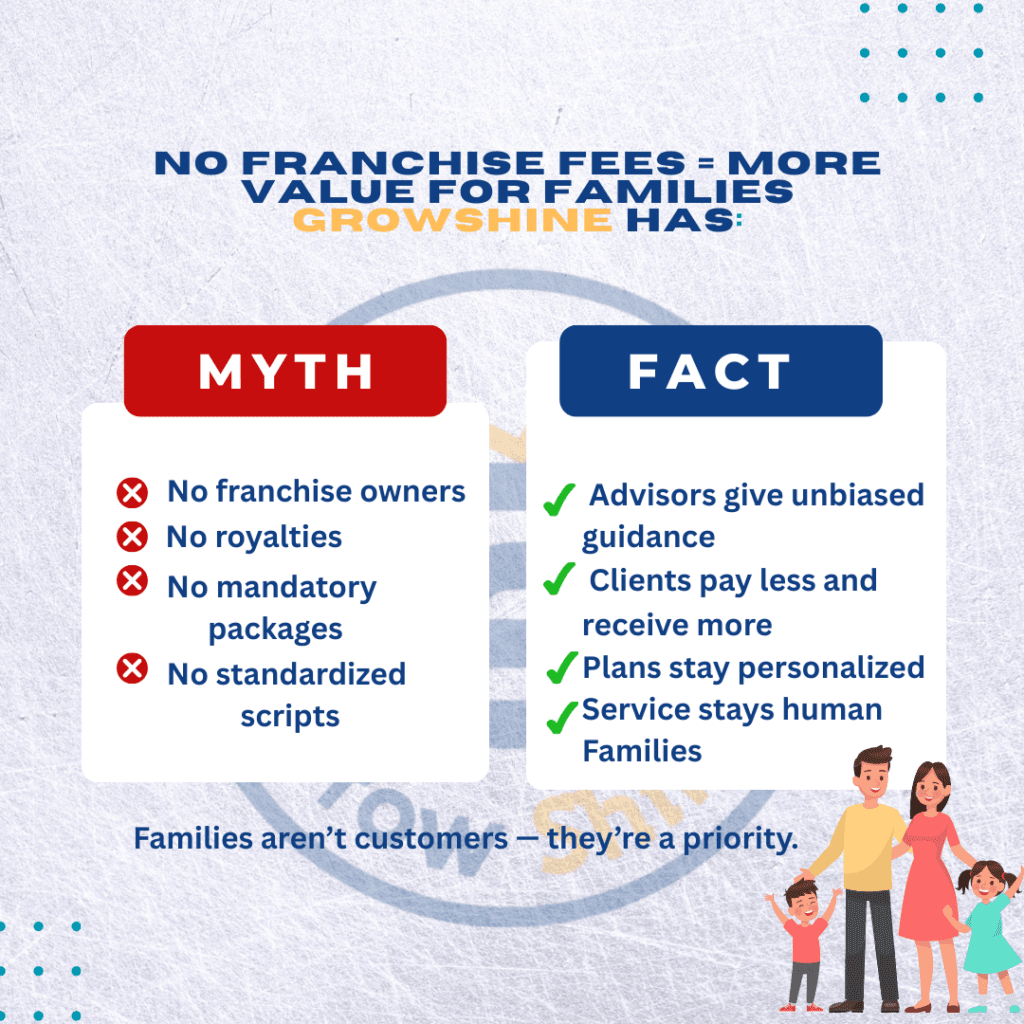

2. No Franchise Fees = More Value for Families GrowShine has:

4. Deep Cultural Understanding

| Good Financial Planning Needs | At GrowShinefin, we simplify. |

|---|---|

| Listening | Trusts |

| Patience | Tax-free strategies |

| Emotional understanding | Beneficiary planning |

| Clear guidance | Retirement options |

| Long-term support | Life insurance |

5. Education-First Growth Model

Instead of heavy marketing spend, GrowShine grows by teaching families.

Our ecosystem includes:

- Weekly financial webinars

- Sunday Legacy Wisdom

- WhatsApp education

- Tax-free retirement guidance

- Simple breakdown videos

- Real family success stories

When people learn from you…they trust you for life.

6. Scalable Without Branches

We scale through:

- Digital learning

- Referral networks

- AI-powered education

- Community trust

Not by adding branches—but by empowering families.

7. The Brand That Grows With People

Franchises expand through geography. Growshinefin expands through trust.

Every family becomes an ambassador because their experience is

- Transparent

- Personalized

- Culturally aligned

- Supportive

- Impactful

Chapter 6: What Siri & Krishna Learned—And What You Can Learn Too

Their biggest realization was simple yet life-changing:

“A franchise doesn’t guarantee freedom. A community guarantees support.”

Franchise = Stress

Community = Clarity

Franchise = Pressure

GrowShine = Guidance

Franchise = Transaction

GrowShinefin = Transformation

This is the Growshinefin difference.

Conclusion: You Don’t Need a Franchise to Create Impact

GrowShine proves that meaningful growth comes from:

✔ Trust

✔ Honest education

✔ Cultural sensitivity

✔ Human connection

✔ Protection for families

✔ Relationship-first service

This is not the franchise way.

This is the GrowShine way.

A community built not by contracts —

but by care.

Short FAQ

Q1. Is franchising always safer than starting my own brand?

Franchising is usually less risky because of the proven model and support. But success still depends on location, effort, and market conditions.

Q2. Can I turn my independent business into a franchise later?

Yes. Many famous franchises started as single independent outlets and later built a franchise system once their model was stable.

Q3. Can I switch from a franchise to independent later?

Possible, but complex. It usually involves:

- Exiting or waiting for the contract term

- Rebranding

- Losing rights to use the old brand

Always take legal advice before deciding

Phone Number: +1 (609) 674-7817

Email: [email protected]

Stay connected with us on Instagram ID: growandshinefin Get daily insights and inspiration